Hi there guys!

I’m continuing to send this monthly digest for chemical engineers.

Do let me know by (replying to this e-mail) what you think about it! Last newsletter covered up some industries of Manufacturing and Energy.

Now, we will focus our attention in the “Industry Tech Trends”, in this specific case, in Carbon Mitigation Technologies.

- Chemical Industry News

- Chemical Industry Stocks & Markets

- Industry Technology & Trends

- What’s up with Social Media Trends

- Product of the Month

Chemical Industry News

This is what you may have missed from the Chemical Industry!

Short News

- Energy: Oil prices jumped as much as 8% last night after OPEC and its allies made the surprising decision to cut output. The White House can’t be happy with the Saudis, since the production cut could be inflationary and lead to higher gas prices for Americans. (read more)

- Pollution: New Jersey is suing Dow Chemical and other companies for allegedly contaminating the state and its drinking water with 1,4-dioxane, seeking compensations, penalties, and natural resource damages for harming the state’s natural resources with the suspected human carcinogen. (read more)

- Silicon Valley & the Chemical Industry: The collapse of Silicon Valley Bank (SVB) has removed a major source of funding for the life sciences sector, especially for startups and young companies. SVB was unique for its funding of the life science sector, and its demise will make it more difficult (and expensive) for growing companies to access capital investment and loans. With interest rates rising, the appetite for riskier biotech investments has decreased, potentially making it harder for companies to raise money. (read more)

- Exxon Profits: Exxon Mobil’s Q1 operating profit is expected to decrease from last year’s record levels due to lower oil and gas prices in comparison to Q4 2022, with upstream earnings likely to be affected by lower natural gas and oil prices, as per the 8-K filing, and the stock closed -0.9% in Tuesday’s trading following OPEC’s output cut (read more)

- Iberdrola to Sell Gas: Iberdrola has signed a draft agreement to sell more than 8,500 MW of combined cycle gas and wind assets in Mexico for $6B, with the sale still requiring regulatory approval, and expects to increase earnings by 10%/year, as the company takes advantage of the worldwide transition to sustainable energy production. (read more)

- TESLA: Tesla held an investor day event focused on sustainability and its future plans, including a new manufacturing platform for more efficient EV production, a lithium refinery plant in Texas, and the announcement of a new Gigafactory near Monterrey, Mexico. The company aims to eliminate fossil fuels and switch to all-electric vehicles, with plans for electric planes and boats. Tesla has produced 4 million cars and plans to produce 20 million a year by 2030, and is working on its FSD technology, robotaxi network, and charging infrastructure. Shares of Tesla were down 5.61% after the event.(read more)

PG&E (NYSE:PCG): has hired a new CFO, Chuck Taylor, from Chevron Phillips Chemical, after former CFO Jason Wells left to become CFO at CenterPoint Energy (NYSE:CNP). (read more)

Chemical Industry Stocks & Markets

[DISCLAIMER: This is NOT a financial recommendation. All investment and financial decisions you

make, should be done with a certified professional . This is just for informational purposes]

Lots of interesting things are happening right now: BRICS are going crazy, Iranian-Saudi Arabia truce, lots of “western allies” now buying oil products from Russia, and the US Dollar being ditched by Oilers. For sure this is just the start of a new geopolitical change in the world economics.

Let’s see how this affects Chemical Companies, Markets and their Stock!

Chemical Company Stocks

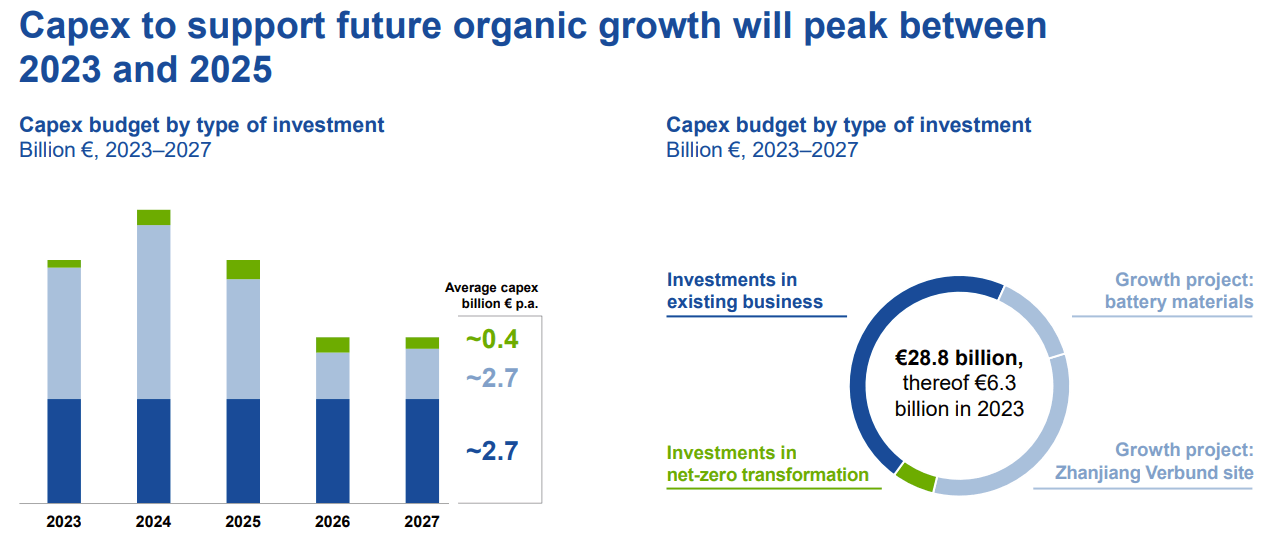

- BASF – is facing declining demand, higher competition and capacity from rivals, and has announced an investment plan of €28.8bn to support sales growth. Its capex will peak between 2023 and 2025, with much of the capital deployed outside Europe at a time of low cycle demand. Although lower gas costs will provide a short-term boost, this could be outweighed by higher interest rates and protectionist pressure. Despite BASF’s compelling valuation and high dividend, the Lab team is not so confident in the short term and has given it a price target of €55 per share ($11.8 in ADR). (read more)

- FirstEnergy shares are expensive with few growth catalysts, leading to a lukewarm relative strength picture and a reiteration of a sell rating ahead of its April 20 earnings date, while long-term buyers should eye a move in the $20s. (read more)

- Continental Aktiengesellschaft’s new auto margin guide is positive, but uncertainties remain in the market, and the company’s execution over the past few years has been inconsistent, and its high-growth areas still have unclear success, making it a risky stock to invest in until there is more progress. The tire business has a more realistic chance of achieving its margin outlook, with benefits from lower material and logistics costs, as well as an increase in replacement sales after inventory normalization in Q1. (read more)

- Genie Energy Ltd. (GNE) is a reseller of energy from the wholesale market to retail consumers. It comprises two main businesses: Genie Retail Energy (GRE) and Genie Renewables. GRE provides traditional electricity and natural gas to residential and small business customers, while Genie Renewables provides renewable sources of energy, primarily solar energy solutions. GNE’s revenue trend has largely stagnated, and its profits are mostly derived from cost-cutting measures, rather than organic growth. While the company is significantly undervalued, it does not offer a superior dividend yield compared to its peers, making it a possible value play but not a compelling one. (read more)

- Wacker Chemie expects weaker demand and prices in 1Q23, which reflects uncertainty over the rate of improvement in demand and raises concerns about the firm’s high exposure to the construction market, making it necessary to see a significant acceleration in earnings growth for the rest of FY23. Therefore, a wait-and-see approach is fair. (read more)

- CTI BioPharma reported Q4 2022 earnings with VONJO sales of $21.1 million, which missed consensus estimates, but the company demonstrated strong new prescription growth in the community setting, with a significant amount of off-label use and plans to submit its PACIFICA results to EMA, expected in 2026, with a projected EU launch in 2027.(read more)

- Commercial Metals (NYSE:CMC) reported a 2Q23 EBITDA beat thanks to stronger steel margins in North America, despite higher costs in Europe.

- The outlook for steel demand in North America is positive, with non-residential construction and infrastructure projects driving demand.

- However, caution is advised regarding Europe’s demand prospects, given weak economic sentiment and energy concerns.

- The impact of Turkey’s reconstruction on the scrap and rebar markets remains uncertain, but domestic rebar prices could benefit from decreased Turkish exports. The analyst maintains a hold rating on CMC for now. (read more)

ETF worth checking out (containing Gold Only)

Industry Tech Trends

Let’s talk about Carbon Mitigation Technologies.

- What are they?

- these are technologies that are designed to reduce, capture, or remove carbon dioxide (CO2) and other greenhouse gases (GHGs) from the atmosphere in order to mitigate climate change.

- Why so sexy now?

- Carbon mitigation technologies offer economic opportunities for companies and entrepreneurs. For example, renewable energy technologies are becoming increasingly cost-competitive with fossil fuels, and direct air capture technology has the potential to create a new industry for carbon removal and utilization.

- Carbon mitigation technologies are seen as a way for individuals and organizations to take action and reduce their carbon footprint.

- Some Examples:

- Direct & Indirect technologies that help to mitigate Carbon are listed (we love acronyms)

- Renewable Energy Technologies

- Carbon Capture and Storage (CCS)

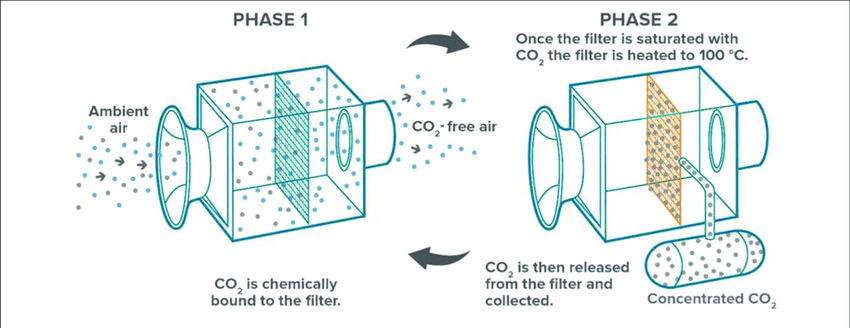

- Direct Air Capture (DAC)

- Bioenergy with Carbon Capture and Storage (BECCS)

- Carbon Farming; Building Energy Efficiency.

- Direct & Indirect technologies that help to mitigate Carbon are listed (we love acronyms)

- Companies Worth Checking Out:

- Carbon Engineering: This company specializes in direct air capture (DAC) technology:

- captures CO2 directly from the atmosphere and stores it in long-term storage facilities.

- Climeworks: Climeworks is another company that specializes in direct air capture technology

- Carbon Clean Solutions: This company offers carbon capture technology for industrial processes:

- Carbon utilization technologies that convert captured CO2 into valuable products.

- this is a start-up; read more here…

- Mitsubishi Heavy Industries: This company offers carbon capture and storage (CCS) technology for power plants and industrial processes, as well as carbon utilization technologies

- GE Renewable Energy: This company offers a range of renewable energy technologies, including:

- wind turbines and hydropower facilities, which generate electricity without producing CO2 emissions

- Carbon Engineering: This company specializes in direct air capture (DAC) technology:

About Social Media

This is a curated list of the most relevant content (video, blog, newsletter, twit, etc.) related to the chemical industry. I think they are quite worth checking out:

- e-mail (Newsletter): My friend Darius Mortazavi just launched a brand new project; its called Feedstock, which is all about how chemicals are made!

- YouTube: I’m currently working on a chemical reactor engineering course… I ended up in a rabithole regarding Chemical Microreactors. Check this lecture out!

- Instagram: Check out Juproop’s Account. It’s all about Chemical Engineering Academics in the UK… just in case you are wondering how they study out there!

- TikTok: In march, there was a viral trend about Mike O’hern. Check how it was used in Chemical Engineering!

- Twitter: If you are into Chemical news via TT, the C&EN account may be a great fit for you!

Product of the Month

This month we explore the Mass Transfer Operations Bundle, which explores a set of unit operations regarding Mass Transfer, but also some Separation Technologies such as Gas Absorption, Distillation Columns, and much more.

Final thoughts

There you have it… a quick glance at the Chemical Industry, their companies, their markets and their technologies.

I’m looking forward to see how the world economics will develop now that the USD is no longer being held as the “golden standard” for international transactions.

This will for sure open lots of chemical markets, but more importantly, will shift the investment backbone of the chemical industry.

As for the carbon mitigation technologies… I do think they are advancing at a good pace, but still dragging for what we need in order to achieve the IPPC goal for 2030 and 2050.

What are your thoughts? Let me know, simply reply, or comment!

Before you go! Check out this promo!

Get access to ALL Courses (See Full Course Offering)

- Cancel Anytime!

- 2nd Month has a 30-day Money Back Warranty

- No questions asked!

* Only for New Students

That will be it guys! I hope you enjoyed this quick summary for the industry!

Is there anything in especial that you liked the most? or Maybe you are not quite into the new trends? Let me know in the comments or via e-mail!