Let's analyze the report!

As an engineer, and actually anyone working in a Chemical or Process Industry, I think is very important to be updated with the news & trends of our industry, but more importantly, in general industries!

This reports make it happen!

First Things First, What is Deloitte?

Deloitte is a global professional services firm that provides a wide range of services to clients in various industries, including audit, tax, consulting, and advisory services. The firm operates in more than 150 countries around the world and has over 330,000 employees. Deloitte’s clients include corporations, government agencies, non-profits, and individuals.

What do they do?

Essentially what they do is assess risk, consult, make trends for industries and of course, lots of more professional services. Deloitte’s services are organized into four main business areas: audit and assurance, consulting, tax, and risk and financial advisory.

Whats the Report About?

There are many reports and outlooks they make, one of my favorite ones are those in the chemical industry, although you could find more on AI, Oil & gas, retail and so on! You can get the direct link to the report here.

How do they make it?

Deloitte fielded a survey of over 100 US executives and other senior leaders in August 2022. The survey captured insights from respondents in four specific industry segments: commodity chemicals, specialty chemicals, agricultural chemicals, and consumer products

Let’s Dive Into the Report!

The report focuses in 4 main points or takeaways:

- Sustainability & Innovation

- Portfolio Transformation

- Supply Chain

- Going Digital

We’ll explore each one of them and make a small analysis on the trend.

But first, some important aspects leading to this changes in the industry.

- Global inflation has been a major concern, which has led to aggressive central bank policies to raise interest rates.

- Continued weakening of GDP growth affects investor trust.

- The consumer confidence index has fallen from a pre-pandemic level.

- Oil price volatility. Russia’s invasion of Ukraine drove oil prices to new highs. (Brent price averaged $107 vs. $65 prior war)

- Tight global gas markets. We all know that natural gas got a hit since Russia’s war. Prices skyrocketed up to €99/MWh

- Impact on feedstock dynamics. With limited incremental OPEC+ supply, the economics of sales of discounted Russian crude to Asian buyers could shape the economics for Naphtha-based olefins.

- Climate change. The growing impact of climate change and the regulatory response have been highly evident in 2022-23. This is now a real issue for companies.

For sure more is to come, but the idea is to “see” how companies strike this balance. The year 2023 is going to be pivotal year setting the stage for the coming transformation of the chemical industry.

The question is: Will this upcoming year be a “rebound” or a “reset” for the industry?

1. Sustainability & Innovation

Many chemical companies have already committed to significant emissions reduction targets.

About 70 global chemical companies have net-zero or carbon-neutrality targets set for 2050, which will require considerable and immediate work. So it no longer looks like a “far away dream”

Any scale capital deployment for sustainability in the near term may be at lower-than-threshold hurdle rates yet may require a larger share of capital deployment.

The new US industrial policy being forged through the Infrastructure Investment and Jobs Act (IIJA) and Inflation Reduction Act (IRA) signal policy support for innovation and for investment in lower-emissions technologies.

Hence, Sustainability & Innovation remain a pilar in the changes and trends of the Chemical Industry.

2. Portfolio Transformation

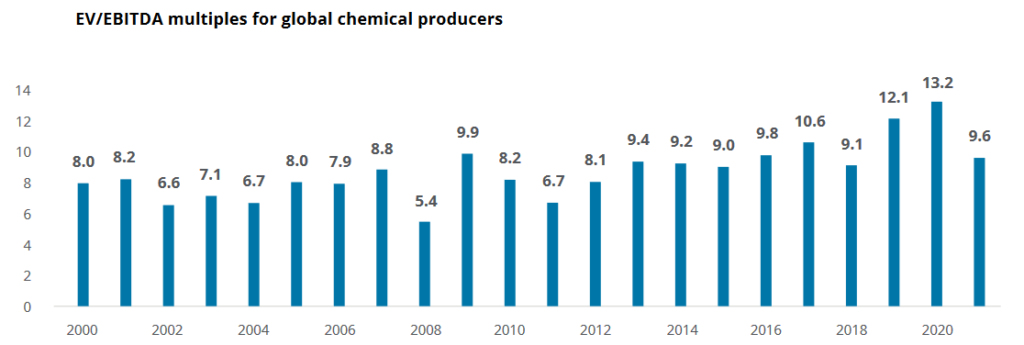

Heading into 2023, the chemical industry is in a strong financial position. The year ahead could be a turning point when companies emphasize the long-term viability of product portfolios in the context of sustainability in a move toward asset-oriented deal-making.

This trend will take longer to scale, given the uncertainty around feedstock prices, energy demand, supply chain, and end-market demand, affecting the appetite for strategic buyers. But the foundations for this shift are being laid in the current environment.

The year 2023 could be a turning point where chemical companies emphasize the long-term viability of product portfolios in the context of sustainability in a move toward asset-oriented deal-making.

This trend will take longer to scale, given the uncertainty around feedstock prices, energy demand, supply chain, and end-market demand, affecting the appetite for strategic buyers. But the foundations for this shift are already being laid in the current environment

3. Supply Chain Management

Over the coming year, reevaluating supply-chain structures will be critical for producers to meet the scale of changes required for the next decade.

Overall, supply chains will need to balance costs and carbon footprint while managing resiliency;

Given the truly globalized nature of the chemical industry and the high dependence on fossil fuel–based pathways, global trade has been a major consideration for the industry.

However, the pandemic and extreme weather events between 2020 and 2021 stress-tested many supply chains globally to the point of breaking. Chemical supply chains fared better than most, experiencing fewer bottlenecks but still suffering disruption.

Also to consider: the CHIPS and Science Act of 2022 has helped jump-start investment in additional semiconductor production capacity in the United States.

Now with geopolitical uncertainty, the industry is seeing the recent shuttering of plants in Europe; another challenge for supply chains to absorb.

- a. Localization of supply chains to further achieve decarbonization goals while building resiliency and redundancy, and

- b. Further incorporation of ESG-related product portfolio changes, moving to circularity and alternate feedstocks and reshaping trade flows.

4. Going Digital

A number of major chemical producers have embarked on various digital journeys across the spectrum: either investing in the digital core or conducting targeted pilots.

The industry has been expanding to digital customer experience, using mobile devices for interaction, deploying predictive analytics for information, and enabling cloud architectures for computation.

These investments over the past five years have been instrumental in establishing the business case for digital.

This digital foundation enabled the industry to essentially migrate to a virtual setting through the pandemic and operate effectively through disruption. Given the uncertainty in the marketplace, investments in the near term facilitate scaled monetization of prior digital investments.

Digital implementation is changing the decision-making landscape of chemical producers. However, the near-term focus will be on stabilizing current platforms and capabilities, with the intent to monetize the current investment pool before expanding to newer areas.

These advances represent the progress by chemical companies on the smart factory journey.

The smart factory of the future for the chemical industry converges the OT, IT, and IIoT (Operational Technology, Information Technology, Industrial Internet of Things) systems leveraging Industry 4.0 and integrates supply chain and operations siloed across planning, scheduling, manufacturing, logistics, and asset management operations execution functions.

Final thoughts

The disruption of 2020-2022 has formed a stage for the coming transformation for the chemical industry.

It has become critical for companies to address supply chain vulnerabilities, even while addressing the imperative for decarbonization and circularity.

Chemical companies in the United States have emerged from 2022 well positioned to take advantage of these changes by using their strong balance sheets and financial discipline. They have the means to adjust their portfolios, retool their supply chains, and anticipate evolving customer preferences in the coming year.

The decisions taken by these companies in 2023 could set the pace for this systemic change which would be great to see how it develops, especially as a young Chemical Engineer!

Before you go! Check out this promo!

Get access to ALL Courses (See Full Course Offering)

- Cancel Anytime!

- 2nd Month has a 30-day Money Back Warranty

- No questions asked!

* Only for New Students

That will be it guys! I hope you enjoyed this quick summary of Deloitte’s Report.

Is there anything in especial that you liked the most? or Maybe you are not quite into the new trends? Let me know in the comments or via e-mail!