Hi there guys!

Hi there guys!

Let’s check out what has been happening in the chemical industry in this month. If you’ve been paying special attention to the global trends and economy, you will know for sure that this was a crazy month.

In short, we’ll cover this topics:

- Chemical Industry News

- Chemical Industry Stocks & Markets

- Industry Technology & Trends

- Catching up with Social Media Trends

- Product of the Month

Subscribe to My Newsletter So You Get All the Most Relevant Monthly News

Chemical Industry News

This month topics are all about economics, acquisitions & investments, oil and gas markets, AI and EV batteries.

Short News:

Inflation Rate on Decline (Beginning Q2):

- The CPI has dropped from 6% to 5%, providing positive news for inflation.

- However, the rate remains higher than the targeted rate, and dropping rates of inflation don’t mean prices are dropping for goods, only that the rate of increase is slowing.

- Corporate earnings reports in mid-April are expected to have an impact on the market. (read more & more)

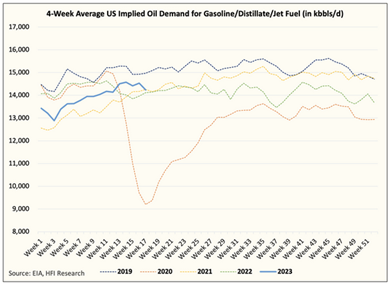

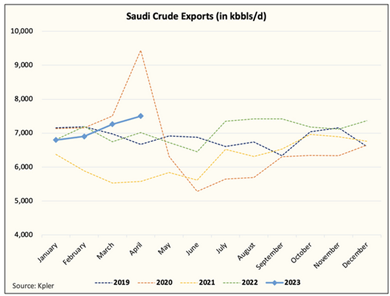

Saudi Arabia’s Oil Production Cuts Will Affect Global Markets:

- Saudi Arabia, the United Arab Emirates, and Iraq have announced sudden cuts in oil production, resulting in a reduction of more than one million barrels of oil per day until the end of 2023.

- These cuts are aimed at stabilizing the oil market, but have led to an immediate jump in global benchmark prices and are expected to result in higher gasoline prices.

- U.S. officials are concerned, but U.S. oil companies could take advantage of the situation and increase their output to take market share from Saudi Arabia and its producing partners. (read more)

Generative AI is dreaming up new proteins:

- Researchers are using AI-powered protein design to create new proteins for various applications, and AI has enabled de novo protein design, creating proteins from scratch.

- Researchers use large language models and diffusion algorithms to design new proteins by training on existing data and generate new solutions. (read more)

Sinopec opens copolymer plant:

- Hainan Baling Chemical New Material, a subsidiary of Sinopec, has started a $280 million SBC plant in China.

- With an annual capacity of 120,000 metric tons for styrene-butadiene-styrene and 50,000 t for styrene-ethylene-butadiene-styrene, Sinopec claims that it is now the world’s largest SBC producer. (read more)

Advanced machine learning model enhances MOF simulations: (read more)

SK On, Westwater to develop anode materials in US for EV batteries:

- SK On, a South Korean battery maker, has signed an agreement to diversify its supply chain by sourcing anode materials in North America in the future.

- This move is in line with the company’s efforts to take advantage of provisions in the Investment Canada Act (IRA). (read more)

More on Lithium, Albemarle to build $1.3 billion US lithium refinery :

Albemarle has announced plans to build a $1.3 billion lithium hydroxide refinery in South Carolina, USA, which will produce 50,000 metric tons of the key material for electric car batteries per year, with potential for expansion to 100,000 tons.

- The facility is expected to begin operation in 2027 and will process recycled material and ore from mines, including a mine the company aims to open 60 km north of the refinery site.

- Currently, the largest lithium refinery in the US can produce 15,000 tons per year.(read more)

Ineos completes $1.4 billion Eagle Ford shale acquisition.

- By providing its own source of supply, the agreement allows Ineos, which currently exports US ethane to its steam crackers in Europe, to have greater control over its supply chain. (read more)

Chemical Industry Stocks & Markets

[DISCLAIMER: This is NOT a financial recommendation. All investment and financial decisions you

make, should be done with a certified professional . This is just for informational purposes]

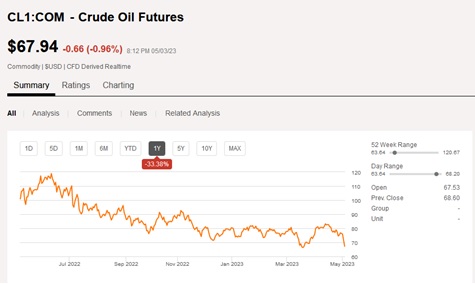

- Let’s get started with Oil & Gas Prices (1Y)

- Down 10% From Highs, Is This Top Semiconductor Supplier a Buy Now? (read more)

- Previously, we’ve talked about some Chemical companies worth checking out & investing in, here is an article covering that. (read more)

- Fertilisers stocks down as market falls!

- Several fertilizers and chemicals companies, including G S F C, Chambal Fertilizers & Chemicals, and Mangalore Chemicals & Fertilizers, saw gains in their stock prices, while others, such as KRISHANA, saw only slight gains or losses, as the overall market fell. (read more)

- LG Chemical reports Q1 results (read more)

- LG Chemical press release

- Q1 operating profit of KRW791B (-22.8% Y/Y) Revenue of KRW14.49T (+24.9% Y/Y)

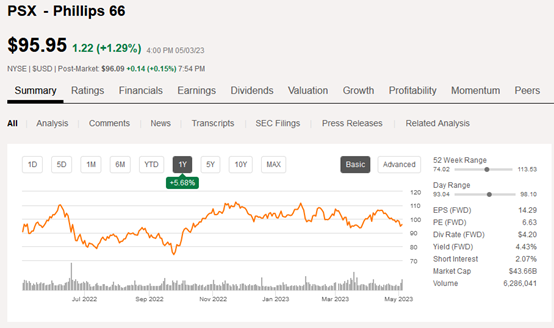

- More on Crude Oil, Phillips 66 sees refineries running in mid-90s in Q2, outpacing rivals (read more)

- Phillips 66’s Q1 net income rose to $1.96 billion, or $4.20/share, beating estimates, due to strong margins from sustained fuel demand and tight crude supplies.

- The company plans to run its 11 refineries in the mid-90% range of their combined crude oil capacity of 1.9M bbl/day in Q2, according to CFO Kevin Mitchell.

- The Q2 utilization forecast was above those from Marathon Petroleum and Valero Energy.

- More on oil? Check out this article What’s Going On With The Oil Market?

- The Surprise of the Month – Stock going skyrocket – The Chemours Company (read more)

Industry Tech Trends

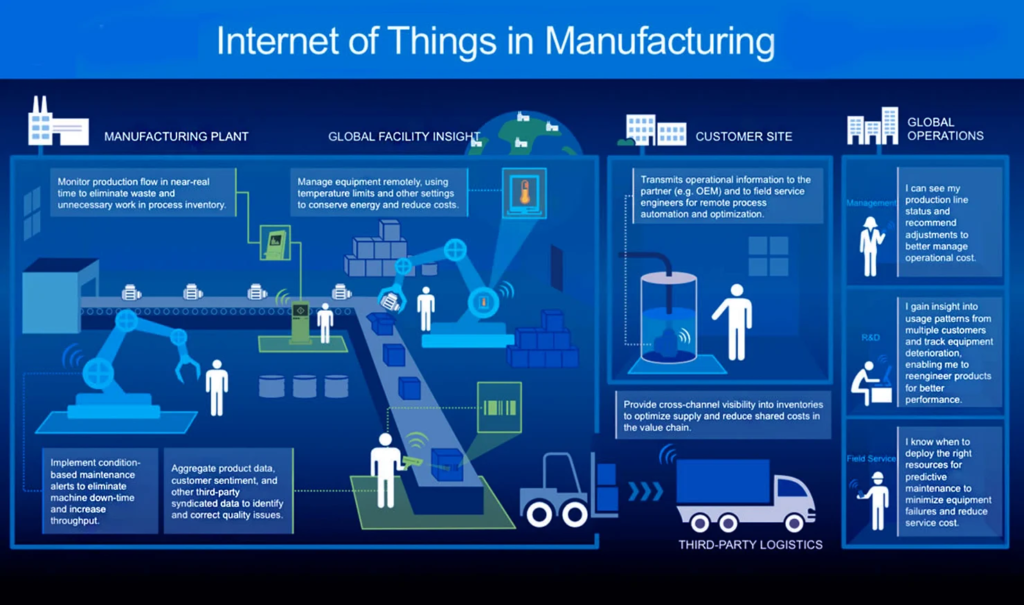

So… you may have heard already the Internet of Things, or properly, the Industrial Internet of Things (IIoT). We’ll focus our attention to this topic in this month issue.

The industrial internet of things (IIoT) is having a significant impact on the chemical industry, revolutionizing the way processes are monitored and optimized.

With the implementation of sensors and connected devices, chemical plants can collect vast amounts of data on variables such as temperature, pressure, and flow rates.

This data is then analyzed by advanced analytics software, enabling plant operators to identify inefficiencies, predict maintenance needs, and optimize production processes in real-time.

IIoT technology is also being used to improve worker safety and reduce downtime caused by equipment failures. Wearable devices equipped with sensors can monitor workers’ vital signs and provide early warning of potential health issues.

Connected equipment can also provide predictive maintenance alerts, allowing for preventative maintenance to be carried out before a breakdown occurs.

Overall, the use of IIoT technology in the chemical industry is improving efficiency, safety, and profitability, making it a key area of investment for many chemical companies.

Advantages:

- Predictive maintenance:

- IIoT enables chemical plants to monitor equipment and detect potential issues before they become major problems.

- This allows for predictive maintenance and reduces downtime, which in turn increases efficiency and saves money.

- Real-time monitoring:

- With IIoT, sensors can be placed throughout the plant to provide real-time monitoring of everything from temperature and pressure to chemical reactions.

- This enables plant operators to make immediate adjustments to maintain optimal operating conditions.

- Supply chain optimization:

- IIoT can be used to monitor and optimize the supply chain, from raw material procurement to final product delivery.

- This can help reduce costs, improve quality control, and increase customer satisfaction.

- Energy management:

- IIoT can help chemical plants monitor and optimize energy use, reducing costs and improving sustainability.

- Data analytics:

- The large amounts of data generated by IIoT can be analyzed using artificial intelligence and machine learning algorithms to identify patterns and optimize operations.

- This can help chemical plants improve efficiency, reduce waste, and increase profitability.

But for sure the IIoT has some drawbacks and challenges which are already happening in the chemical industry.

Here are some examples:

- Security:

- With IIoT, there are concerns over data privacy, as connected devices can become targets for cyberattacks.

- This is a significant concern for the chemical industry since it involves highly sensitive and confidential data.

- Interoperability:

- Integration of multiple systems and devices to form a connected system can be a challenge as not all devices speak the same language.

- With IIoT, it is essential to ensure that different devices, software, and platforms are integrated and working together seamlessly.

- High initial costs:

- The cost of implementing IIoT can be prohibitive, especially for small and medium-sized enterprises which makes a bigger gap.

- Retrofitting older systems and equipment with sensors and connectivity can be expensive, and there may not be a clear return on investment.

- Limited skilled workforce:

- There is a growing need for skilled workers who understand the complexities of IIoT systems

- However, there is a shortage of such professionals in the market.

About Social Media

This is a curated list of the most relevant content (video, blog, newsletter, twit, etc.) related to the chemical industry. I think they are quite worth checking out:

e-mail (Newsletter):

- We talked a lot of Crude Oils in this month… If you are into Crude Oil and Gas, you may be interested in “The Crude Chronicles”.

YouTube:

- I just found this very interesting videos from Chemical Industry Accidents, and how to prevent them. Check it out!

Instagram:

- I’ve been in touch with the author of “The Art of Fugacity”. Check out their work, its funny and educational!

TikTok:

- My friend Andrew has been working in his PhD, and recently as a DJ, check out his content here!

Twitter:

- If you are into Investing, I’ve been following MoneyMan since a few time already. It is about Chemical Industry Stocks.

Product of the Month

Its already May! We are half-way to November Black Friday Sale, so I decided to make a small gift for you guys!

A FREE Monthly subscription so you can check out my courses and content! Let me know what you think about it!

***Please note that it will renew to the current price of $30 USD/mo.

Make no worries, cancel anytime, and if you get charged, just let me know and I’ll refund it myself!

Final thoughts

That will be it guys! I hope you enjoyed this issue! See you next month!

Is there anything in especial that you liked the most? or Maybe you are not quite into the new trends? Just reply to this e-mail and let me know!

That will be it guys! I hope you enjoyed this issue! See you next month!

Is there anything in especial that you liked the most? or Maybe you are not quite into the new trends? Let me know in the comments or via e-mail!