Welcome to the Industry News!

Hi there guys!

Let’s talk about the relevant stuff that happen in the Chemical Industry in this month!

Content:

- Chemical Industry News

- Chemical Industry Stocks & Markets

- Catching Up With Social Media Trends

- Product of the Month

Subscribe to My Newsletter So You Get All the Most Relevant Monthly News

Chemical Industry News

- 3M board approves $6B settlement for combat earplugs:

- To address claims that their combat earplugs failed to protect veterans from hearing loss.

- This amount is lower than the estimated $10 billion to $15 billion.

- The litigation, involving allegations of defective earplugs produced by 3M and Aearo Technologies (a 3M acquisition in 2008), had become the largest mass tort case in U.S. history. The settlement offers clarity on potential product-liability costs for 3M, a company known for products like Post-it Notes and Scotch tape.

- This settlement follows a previous tentative settlement related to water contamination by “forever chemicals,” which could cost 3M up to $12.5 billion.

- In response to this news, 3M’s shares increased by 5.2% and closed at $104.12. (read more)

- China stepping over Canada in the energy transition with world’s largest green hydrogen project

- Sinopec plans to build the world’s largest green hydrogen plant with an annual capacity of 20,000 tons.

- The project aims for completion in mid-2023 and will utilize solar and wind power to produce green hydrogen.

- All the plant’s components, including solar and wind capture equipment and the electrolyzer, will be manufactured in China.

- Previously, the world’s largest green hydrogen plant was inaugurated in Canada by Air Products, with an annual production capacity of 3,000 tons.

- Despite this impressive hydrogen project, it is unlikely to significantly reduce China’s substantial demand for oil, which stands at around 4 million barrels per day (mb/d) or approximately 200 million tons per year.

- (read more)

- Olin’s stock falls 10% on CEO Scott Sutton’s plan to leave chemical maker

- Olin’s stock experienced a 10% decline on Friday following the announcement that CEO Scott Sutton intends to leave the company in the first half of the next year.

- Scott Sutton expressed gratitude for his time as Olin’s leader and stated that the company has a promising future. The board is actively collaborating with him to find a capable leader to facilitate Olin’s continued growth. (read more)

- Bayer investor calls for de-merger of OTC, pharmaceuticals units

- Major investor Artisan Partners is urging Bayer to split its over-the-counter drug and pharmaceutical units.

- This request comes amid efforts by Bayer’s CEO to potentially spin off the agricultural chemicals unit following pressure from activist investors, including Bluebell Capital and Jeff Ubben, who holds a significant stake in the company. (read more)

Texas sues Shell over May fire at Deer Park chemical plant

- Texas has sued Shell and partner Pemex over environmental damage caused by a May fire at a petrochemical complex near Houston.

- The state seeks over $1 million in damages and relief for alleged environmental violations, including the unlawful discharge of wastewater and airborne contaminants.

- Shell also faces private lawsuits from employees and contractors who say they were harmed during the fire.(read more)

DuPont near deal to sell resins unit for $1.8B – report

- DuPont is in advanced discussions to potentially sell its Delrin resins unit for about $1.8 billion to the Jordan Company.

- An announcement may come this week, but the deal is not finalized.

- Earlier, Lone Star Funds and Platinum Equity were also reportedly interested in purchasing the Delrin resins unit for around $2 billion.

- The sale aligns with DuPont’s strategy to refocus on electronics, automotive, and industrial technologies. (read more)

Mitra Chem raising $60 million for battery materials research

- Mitra Chem secures $60 million in series B funding led by General Motors to research AI-driven battery materials, focusing on iron-based cathodes as a cost-effective alternative to existing lithium-ion batteries.

- Their R&D facility enables rapid testing and development.

- They previously raised $20 million in series A funding in November 2021.(read more)

BASF signs deal to import LNG from US

- BASF has entered a long-term contract with Cheniere Energy.The deal reflects growing European demand for LNG due to reduced natural gas imports from Russia.

- The contract involves importing 800,000 metric tons per year of liquefied natural gas (LNG) from the US to Europe.

- Deliveries are set to commence in mid-2026 and will continue until 2043.

- Cheniere Energy operates LNG facilities in Louisiana and Texas. (read more)

- Northvolt raises $1.2 billion for expansion

- Northvolt, a Swedish lithium-ion battery manufacturer, secured $1.2 billion in funding.

- Investors such as BlackRock and the Canada Pension Plan Investment Board are backing the expansion of Northvolt’s operations in Europe and North America.

- Northvolt is currently setting up its initial battery systems production for stationary energy storage in Poland.

- The company also has expansion plans in Germany, Portugal, and Sweden, aiming to broaden its manufacturing presence. (read more)

- Automated chemistry specialist Chemify lands $43 million in funding

- Chemify, an AI-driven molecular design and synthesis company, secures $43 million in series A funding led by Triatomic Capital.

- The company’s unique offering is XDL, a computational language that bridges AI and robotics in automated labs.

- XDL aims to establish a standard for computational operations in the field.

- The funding reflects the growing competition in automated labs and their increasing relevance in various chemical applications.(read more)

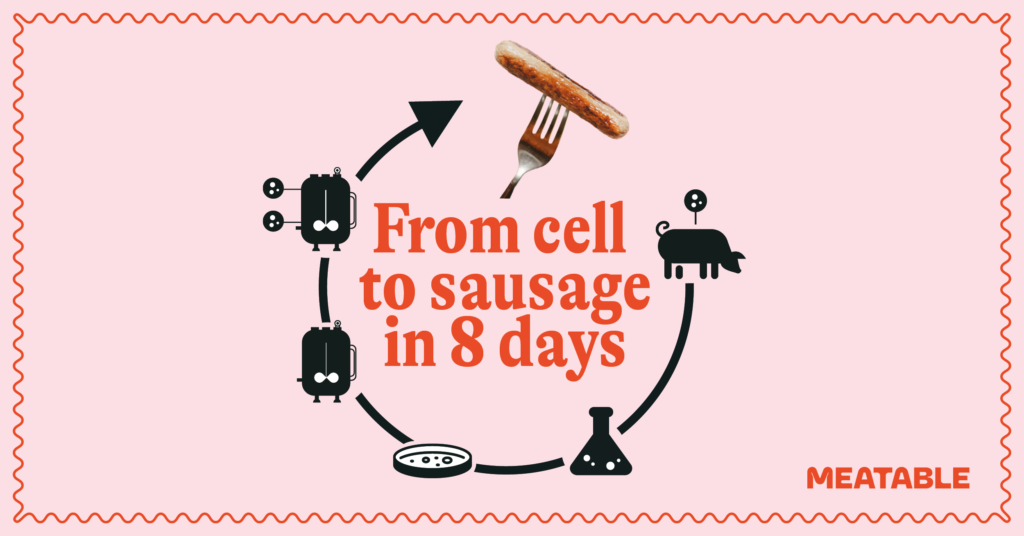

Meatable raises $35 million for cell-grown meat

- Dutch start-up Meatable raises $35 million in funding from investors like Agronomics and Invest-NL.

- Goal: Scale up lab-grown meat production and prepare for commercial launch.

- Aims to reduce costs to compete with traditional meat.

- Plans to debut sausages and pork dumplings in Singapore next year and expand into the US, where approvals for cell-grown meat have recently been granted to other firms.(read more)

- China’s Manufacturing shrank

- For the fifth straight month in August, urging calls for government intervention.

- The official PMI rose to 49.7, slightly better than July’s 49.3. Global demand slump and low domestic spending have hurt manufacturers, causing deflation and July’s industrial profit contraction.

- China’s outlook is murky

- China’s economic prospects remain dim as analysts reduce growth, price, and trade forecasts, anticipating increased monetary policy interventions.

- Economists project 2023 GDP growth at 5.1%, down from 5.2%, aligning with the government’s conservative 5% target. Despite Beijing’s support efforts, global investors have withdrawn from Chinese markets.

SHORTS:

- 10yUS -0.03%: The U.S. 10-year Treasury yield surged to 4.198%, the highest since November, driven by Fitch’s credit rating downgrade. Later, it slightly dipped below 4.194% during late afternoon trade.

- US Unemployment at the lowest level since 1969 U.S. job growth moderated in July, with nonfarm payrolls expanding by 187,000—slightly below the Dow Jones estimate of 200,000 but slightly better than June’s revised figure of 185,000. Unemployment dipped to 3.5%, the lowest since late 1969, pleasing both workers and the Federal Reserve.

- Eurozone’s second-quarter GDP outperformed expectations, expanding by 0.3%, while July’s inflation slightly dropped to 5.3%. However, economists remain cautious about the possibility of a recession despite signs of economic recovery.

Even shorter:

- Covestro Opens New Elastomer Plant in China

- Fluor Awarded Nearly €1 Billion in Life Science Contracts

- Brazil’s Braskem Q2 Earnings Down, Possible Divestment Needed

- Occidental to Acquire Carbon Engineering for $1.1 Billion

- DuPont to Divest Majority Stake in Delrin Business to TJC

- LG Chem to Spend $95 Million on Water Treatment Business

Chemical Industry Stocks & Markets

[DISCLAIMER: This is NOT a financial recommendation. All investment and financial decisions you

make, should be done with a certified professional . This is just for informational purposes]

- Stocks are entering September, a historically challenging month for the S&P 500.

- Since 1945, the index has typically dropped by 0.7% during September. However, in 2023, after a strong start, history might potentially favour investors.

- When the S&P 500 rises by over 10% entering August, as it did this year, it typically falls 3.2% in August. In 2023, it only fell 1.7% in August.

- Historically, in these cases, the S&P 500 tends to rise by an average of 2.3% in September and over 9% from September through year-end.

- ON Semiconductor’s shares surged by 2.5% as the chipmaker reported better-than-expected results for the second quarter.

- Earnings per share (excluding items) stood at $1.33, with revenue reaching $2.09 billion, surpassing FactSet’s estimates of $1.21 earnings per share and $2.02 billion in revenue.

- Dominion Energy (D -3.06%) to report Q2 earnings today.

- Declining growth and interruptions at a nuclear plant affected its operational EPS guidance.

- Analysts expect $0.47 EPS and $3.72B revenue. Recent quarters showed mixed results, beating EPS but missing revenue estimates.

- OIL -0.22% Oil prices saw a strong rebound last week, benefiting from a weaker US dollar, and even a strengthening dollar on Thursday couldn’t halt the upward momentum.

- Looking ahead, last September’s $89 high and October’s high at $92.95 are key levels to monitor in the medium-term.

- Check prices here

- NATGAS 0.41% The focus is on avoiding a strike in Australia’s LNG sector.

- Woodside Energy’s offer gained support from LNG unions, while Chevron faces disputes with potential strike threats at its Australian operations, impacting markets.

- As the likelihood of strikes decreases, European natural gas prices fell.

- EuroNatGas -0.27% European gas prices surged almost 40% due to Australian supply concerns, driven by potential strikes at LNG plants.

- TTF hub prices peaked since mid-June, influenced by the Chevron and Woodside worker-led strike threat.

- Despite ample European inventories, the trend is anticipated to continue amid ongoing heatwaves. U.S. gas futures also rose.

RICE: The price of rice has reached its highest point in nearly 12 years, primarily due to limited supplies caused by India’s rice export ban and unfavorable weather conditions in Asia, where rice is a staple food.

- Looming lithium shortage due to soaring demand, possibly by 2025.

- Fitch Solutions predicts China’s demand to outpace supply by 2025.

- EV lithium demand in China projected to rise 20.4% annually over 2023-2032, while supply up only 6%, proving insufficient for a third of needs.

- SAOC 0.78% Saudi Aramco, the world’s top oil exporter, reported a 38% drop in Q2 profit to $30.07bn, citing lower hydrocarbon prices, weak refining and chemicals margins, and OPEC+ production cuts.

- Shares fell despite an increased dividend of $29.4bn.

About Social Media

This is a curated list of the most relevant content (video, blog, newsletter, twit, etc.) related to the chemical industry. I think they are quite worth checking out:

- e-mail (Newsletter): Recently, I came across an article on AI written by Davansh, featured in the newsletter “Artificial Intelligence Made Simple.” It’s definitely worth a read as it delves into theoretical, philosophical, and practical questions related to AI.

- YouTube: Are you a young engineer, looking for a job? Tamer Shaheen covers some interesting concepts for job hunts, interviews and day in the life of recent graduates: Check this video!

- Instagram: One of my favorite accounts is called DepthsOfWikipedia. You can find random facts and crazy stuff out there!

- TikTok: In case you were wondering, Data Scientists are the top paid “recent graduate” engineers in the US. (Video)

- Twitter/X: Did you miss Falcon 9 and Dragon Vertical Launch? Check it here

Product of the Month

Well, I’m pretty sure you already got my previous e-mails, but in case you didn’t: I launched a New Course, Its all about World Energy, Global Markets and Energy Trade. We learn about:

- The Big Players in the Energy Sector

- International Trade

- Fossil Fuels status quo and near future

- Renewables trend, and transition

- Carbon Emissions

As usual, you have a 30-Day Money Back Warranty, if you don’t like the course or bundle so make no worries, enroll now and boost your training skills!

Final thoughts

This past month has been quite pleasant, marked by a global decline in inflation rates, which is contributing to the gradual normalization of economic conditions.

While financial institutions, both public and private, continue to exercise prudence and caution in their operations, there is an optimistic anticipation that the current state of affairs will soon fall into a more stable and orderly pattern.

The decreasing inflationary pressures have instilled a sense of hope that economic conditions will steadily improve, leading to increased confidence in financial markets.

See you next month!

Is there anything in especial that you liked the most? or Maybe you are not quite into the new trends? Just reply to this e-mail and let me know!

Is there anything in especial that you liked the most? or Maybe you are not quite into the new trends? Just reply to this e-mail and let me know!